After decades of digital transformation and billions spent on technology, you'd expect financial services and insurance to feel fundamentally different by now. In some ways, they do. But spend a day inside most banks or insurers and a different picture emerges, compliance teams still wading through hundreds of manual alerts every morning, loan applications stuck in queues for days, claims adjusters logging into system after system just to pull together information that should already be in one place.

The uncomfortable truth is that all that investment largely automated the edges. The work that actually drives outcomes, the risk calls, the fraud catches, the compliance decisions, the complex customer situations, stayed with people. And yet, despite 88% of organizations now using AI in at least one business function, McKinsey finds that only 6% qualify as true high performers where AI meaningfully moves the needle on profitability. The technology got more sophisticated. The outcomes didn't keep pace.

Something has to give. Customer expectations aren't slowing down. Fraud losses are projected to hit $40 billion by 2027. Regulatory requirements keep multiplying across jurisdictions. And the $170 billion in global banking profits now at risk isn't a warning for the future, it's a present-day reality for institutions still relying on the same underlying approach: more rules, more manual reviews, more siloed tools.

The Reality Check: Why Traditional AI Falls Short

Financial services and insurance institutions are under pressure from every direction. Customer expectations have fundamentally shifted, they want loan decisions in hours, claims settled in days, and support available around the clock. At the same time, fraud is getting more sophisticated, regulatory requirements are multiplying across jurisdictions, and operational costs keep climbing. The volume and complexity of decisions these institutions need to make daily, across lending, compliance, risk, and customer service has grown beyond what traditional systems were ever designed to handle.

And yet, most institutions are still running on fragmented technology stacks, disconnected data systems, and rule-based automation that reacts to yesterday's patterns. The result? Fraud slips through. Loan applications stall. Compliance teams drown in manual reviews. Customers get generic responses instead of real answers.

The industry has invested heavily in AI to solve this. According to Gartner, by late 2025, over 70% of financial institutions will be using AI at scale, up from just 30% in 2023. But adoption hasn't translated to impact, McKinsey reveals only 6% of companies qualify as "high performers" where AI contributes meaningfully to EBIT in a lasting way. The problem isn't effort or investment. It's that traditional AI was built for straight lines, and FSI doesn't have any.

The stakes are real:

- $340+ billion in regulatory fines since 2019

- Fraud losses projected to hit $40 billion by 2027

- $170 billion in global banking profits at risk for institutions that fail to adapt

The industry isn't suffering from a lack of AI. It's suffering from AI that can't think intelligently enough, act fast enough, or coordinate autonomously enough to meet the moment.

Enter Agentic AI: Intelligence That Actually Acts

For years, financial institutions have automated the predictable and hired people to handle everything else. That model is breaking. The volume of decisions is too high. The regulatory environment is too complex. The fraud is too sophisticated. And customers expect answers in seconds, not days.

Agentic AI doesn't just make existing workflows faster. It changes what's possible, turning multi-day processes into minutes, replacing reactive rule-checks with proactive intelligence, and letting human teams focus on judgment calls that actually require them. The shift isn't from manual to automated. It's a fundamental shift from rule-based automation to completing outcomes.

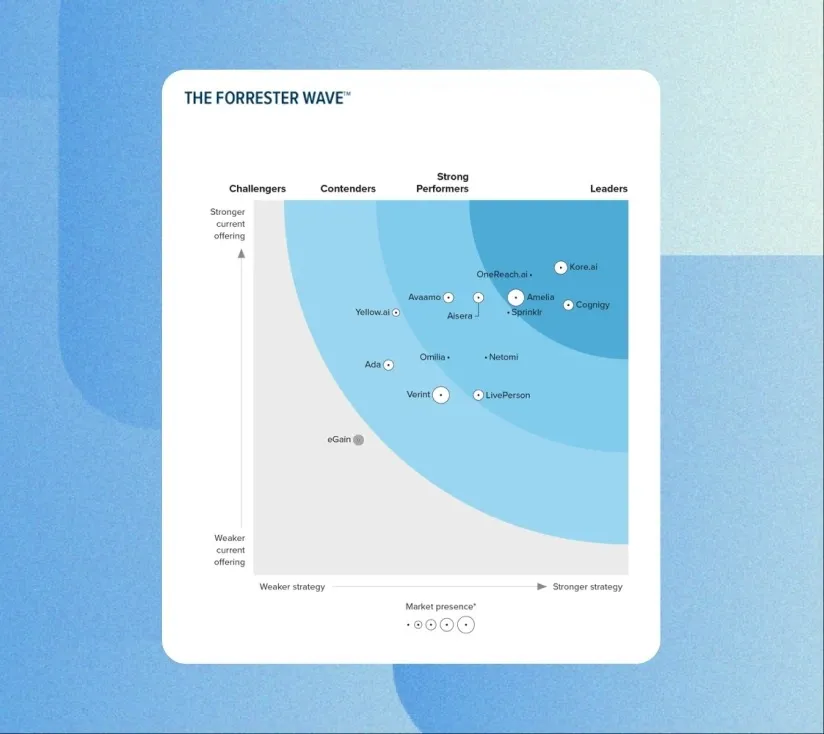

The Market Recognizes This Shift:

According to KPMG's research, agentic AI is projected to unlock $3 trillion in corporate productivity and deliver a 5.4% EBITDA improvement for the average company annually based on research of more than 17 million firms.

Deloitte predicts that by 2027, 50% of enterprises using generative AI will deploy agentic AI, up from 25% in 2025.

The financial services sector is already seeing proof:

- A US bank that deployed AI agents to transform credit risk memo creation experienced a 20-60% increase in productivity and a 30% improvement in credit turnaround time (Source: McKinsey)

- PwC reports that AI agents can reduce cycle times by up to 80% in purchase order processing while improving audit trails and reducing compliance risk

- Deloitte projects that by using AI to integrate real-time analysis, P&C insurers could reduce fraudulent claims and save between $80 billion and $160 billion by 2032

The question isn't whether agentic AI will transform financial services and insurance. The market has already answered that. The question is whether your organization will lead this transformation or be forced to catch up after your competitors pull ahead.

What Is Agentic AI in Financial Services and Insurance?

Agentic AI represents a fundamental shift from automation to autonomy. Unlike traditional financial services AI that executes tasks based on pre-programmed rules, agentic AI can perceive context, reason through multi-step problems, make decisions, and take action, all without constant human intervention.

Think of it this way: Traditional AI is like a compliance officer who follows a checklist. It waits for input, applies predetermined rules, and delivers a binary output. Agentic AI is more like an experienced financial crimes investigator who understands transaction patterns, evaluates risk factors across multiple data sources, considers regulatory constraints, and makes intelligent decisions that balance fraud prevention with customer experience, all in real time.

The Core Capabilities of Agentic AI for Financial Services and Insurance:

- Goal-Driven Reasoning: Unlike rule-based systems, AI agents work backward from desired outcomes (e.g., "approve creditworthy loans while minimizing default risk and maintaining regulatory compliance") and determine the best path forward. They don't just follow steps; they figure out which steps make sense.

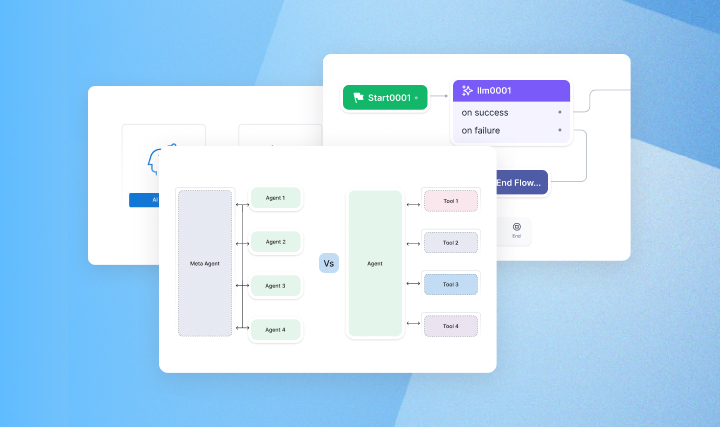

- Multi-Agent Orchestration: Different AI agents collaborate across lending, fraud detection, insurance underwriting, claims processing, compliance, and customer service, sharing context and coordinating actions seamlessly. One agent's output becomes another agent's input, creating intelligent workflows that span the entire organization.

- Real-Time Adaptation: Agentic AI continuously monitors signals across channels and adjusts strategies dynamically as conditions change, from emerging fraud patterns to regulatory updates to shifts in customer sentiment. It doesn't wait for the next quarterly model refresh.

- Autonomous Execution: Once deployed with proper guardrails, agentic AI can execute complex workflows, from loan processing to fraud investigation to claims adjudication to dispute resolution, without requiring human approval for every decision. Humans set the rules and monitor outcomes; agents handle execution.

Financial institutions are already deploying agentic systems, and the results are transforming industry benchmarks.

Citizens Bank's 2026 AI Trends report reveals that 82% of midsize companies and 95% of private equity firms have either begun or plan to implement agentic AI in their operations in 2026. Of those organizations that have already adopted agentic AI, 99% agree it has improved their operational efficiency and workforce productivity.

The market recognizes this shift. But here's what separates winners from everyone else: how fast you move from experimentation to production, and how well you govern it along the way.

The gap between early adopters and laggards is widening. Banks and insurers implementing agentic AI are seeing 70% reduction in loan processing time, 85% drop in fraud false positives, and 60% reduction in manual KYC workload. Those relying on traditional automation are struggling to keep pace with customer expectations that evolve daily.

Here Are a Few Stats to Know on Agentic AI in FSI

Adoption is accelerating, but execution remains the challenge:

- The financial services and insurance sectors are undergoing rapid transformation. McKinsey research shows that in any given business function, no more than 10% of respondents report scaling AI agents. Most organizations' scaling agents are doing so in only one or two functions, not enterprise-wide.

Data quality, legacy systems, and governance remain make-or-break challenges:

- The top barriers? KPMG research reveals 48% cite data governance concerns, 30% flag privacy issues, and 20% admit their data isn't ready.

- The cost of these failures is real: 77% of organizations report financial losses from AI incidents, and 55% report reputational damage due to data implementation and governance challenges.

Trust, explainability, and ROI measurement are non-negotiable in regulated environments:

- The EU AI Act stages compliance requirements through 2027, with non-compliance penalties reaching up to 6% of global annual turnover for high-risk AI systems. In the US, the SEC has issued new guidance on algorithmic trading and AI-driven investment advice, while the FCA in the UK has increased scrutiny of AI-powered risk models.

- According to PwC research, early-stage involvement of compliance experts can reduce the likelihood of regulatory breaches by over 70%.

- Yet here's the opportunity: KPMG projects that organizations can achieve an average 2.3x return on agentic AI investments within 13 months, with ROI expected to grow as adoption scales.

- McKinsey research shows that 58% of financial institutions directly attribute revenue growth to AI, primarily through enhanced trading performance, predictive risk management, and automation of operational processes.

Why Financial Services and Insurance Sector Need Agentic AI Right Now

Financial institutions and insurers operate at the intersection of rising customer expectations, tightening regulatory oversight, and unprecedented operational complexity. The systems that powered the industry a decade ago, or even three years ago, simply cannot handle the pace and volume of decisions required today.

1. Customer Journeys Have Become Impossibly Complex

A single customer might research a mortgage online, compare rates across six banks, submit an application through a mobile app, upload documents via email, receive automated status updates, chat with customer service about missing information, visit a branch to ask questions, and complete closing through a digital platform, all within 14 days.

In insurance, a policyholder might get a quote online, compare coverage on an aggregator site, purchase through an agent, file a claim via mobile app, upload damage photos, receive an adjuster visit, follow up through chat, and get payment via direct deposit, each touchpoint managed by different systems.

Each interaction generates decisions: What documents do we still need? Is this application flagged for fraud? Should we offer a rate adjustment? How do we communicate the next steps? What's the optimal approval path? Is this claim suspicious? What's the coverage determination?

Traditional systems handle these decisions in isolation, creating friction and inconsistency. Agentic AI connects them into one intelligent flow, carrying context across every interaction.

2. Labor Constraints Are Permanent, Not Cyclical

Financial services face a structural talent crisis. Underwriters, compliance analysts, fraud investigators, and claims adjusters, these roles are hard to fill and expensive to train. According to your own industry data from the FSI guide, 60% of firms report that KYC reviews are a major operational burden, and compliance teams spend up to 70% of their time on manual data validation.

In insurance, the challenge is similar. Adjusters spend 40% of their time just gathering information across disconnected systems. Underwriters devote up to 15 hours weekly to manual onboarding and policy setup.

Hiring more people isn't solving the problem; it's compounding costs. Financial institutions need technology that amplifies existing teams rather than replacing them.

Agentic AI provides this amplification. It handles the cognitive load of routine decisions, document validation, risk scoring, regulatory checks, fraud triage, claims routing, so human teams can focus on judgment-based work that builds customer relationships and manages exceptions.

3. Legacy Systems Are Becoming Competitive Liabilities

Many banks still run on fragmented technology stacks: mainframe core banking systems from the 1980s, rigid loan origination platforms, disconnected fraud detection tools. Insurers face similar challenges with policy administration systems that weren't designed for omnichannel coordination or real-time decisioning.

Banks and insurers can't afford to wait for full modernization. Agentic AI offers a bridge, working across existing systems to create intelligence and coordination that legacy infrastructure alone cannot provide.

4. Regulatory Pressure Is Escalating, Not Easing

The EU AI Act imposes staged compliance requirements through 2027. US regulators are tightening oversight on model risk management, third-party governance, and algorithmic bias. The Deloitte Center for Financial Services warns that GenAI-enabled fraud is expected to drive losses from $12 billion in 2023 to $40 billion by 2027, forcing institutions to adopt more sophisticated detection capabilities.

Institutions that deploy AI without explainability, audit trails, and human oversight face regulatory scrutiny that can result in fines exceeding the cost savings AI was supposed to deliver. Agentic AI built with governance in mind, with logging, explainability, bias monitoring, and human-in-the-loop controls, helps institutions innovate while staying compliant.

5. The AI Investment Surge Signals an Inflection Point

Major financial institutions are making unprecedented commitments. JPMorgan Chase is investing $4 billion in AI in 2025, nearly one-third of its total tech budget. Bank of America is investing $4 billion in new technology and AI. This isn't an experimental budget. It's a strategic investment in survival.

Goldman Sachs has achieved over 90% internal AI adoption, pulling ahead of the industry average of 73%. Morgan Stanley's AI assistant achieved 98% adoption among financial advisor teams, saving 30 minutes per client meeting across 1 million annual calls.

The question is no longer "Should we adopt agentic AI?" but "How quickly can we scale it before competitors pull ahead?"

Real-World Use Cases: Where Agentic AI Delivers Measurable Impact

The shift from traditional automation to agentic AI isn't theoretical. Financial institutions and insurers are already deploying AI agents across critical workflows, and the results are transforming industry benchmarks. Here's where the technology is making the biggest difference:

These use cases target specialized workflows unique to financial services and insurance, from compliance and fraud detection to portfolio management and claims processing.

The Strategic Benefits of Agentic AI in Financial Services and Insurance

The shift to agentic AI delivers measurable advantages across three dimensions: operational efficiency, competitive positioning, and regulatory resilience. But the real transformation isn't about isolated improvements; it's about fundamentally changing how financial institutions operate, compete, and serve customers.

1. Operational Efficiency That Compounds Over Time

Traditional automation delivers linear improvements. Agentic AI creates exponential value because the systems get smarter, not just faster.

Productivity Gains Across Core Functions:

According to research, agentic AI unlocks trillions in corporate productivity improvements globally, with financial services positioned to capture a disproportionate share. The numbers in practice:

- Credit and lending operations: Financial institutions are seeing dramatic improvements in processing speed and analyst productivity across the board.

- Compliance and risk management: Institutions report substantial reductions in manual KYC workload and significant improvements in early detection of high-risk accounts. The shift from periodic reviews to continuous monitoring enables compliance teams to catch problems before they escalate into regulatory events.

- Fraud detection: Traditional rules-based systems force teams to review thousands of false positives daily. Agentic AI dramatically reduces false positives while increasing actual fraud detection rates by 20-300%, depending on baseline capabilities. For a mid-sized bank processing 100,000 daily transactions, that translates to 40+ hours weekly saved on manual reviews.

- Customer service: Resolution times drop by 50% or more, ticket volumes decrease by 27%, and operational costs fall by 30-40%. More importantly, 70-80% of routine inquiries are resolved without human intervention, freeing support teams to handle complex cases that build customer relationships.

Cost Reductions That Go Beyond Headcount:

The immediate ROI is clear. KPMG projects organizations can achieve an average 2.3x return on agentic AI investments within 13 months. But the less obvious savings compound:

- Reduced error correction costs: 90% reduction in manual data entry errors means fewer chargebacks, fewer compliance incidents, and fewer customer complaints.

- Lower customer acquisition costs: When onboarding takes 60% less time and 18% fewer applicants abandon the process, you convert more prospects without increasing marketing spend.

- Decreased regulatory penalties: Institutions deploying AI with proper governance frameworks significantly reduce compliance breaches. Given that regulatory fines have reached hundreds of billions in recent years, even modest improvements carry eight-figure value.

2. Competitive Positioning in a Bifurcating Market

The financial services industry is splitting into two groups: institutions that use AI to transform operations, and those trying to catch up. The performance gap is already measurable and widening.

The Winner-Take-Most Dynamic:

McKinsey's research reveals a stark reality. AI leaders in financial services far outperform laggards on investment returns. In insurance, AI leaders have delivered 6.1x the total shareholder return of AI laggards over the past five years.

This isn't just about technology adoption. It's about creating structural advantages that competitors can't easily replicate:

- Speed to market: When your loan processing takes 3 days instead of 10, you win customers who need fast answers. When your claims adjudication takes hours instead of weeks, you build loyalty that survives rate comparisons.

- Customer experience differentiation: 72% of customers expect 24/7 support, but only 38% of banks deliver it. Agentic AI makes round-the-clock, context-aware service economically viable.

- Pricing power through efficiency: Institutions that achieve 50-70% cost reductions in core processes can offer better rates while maintaining margins. That pricing advantage compounds in competitive bidding situations.

First-Mover Advantages Are Real:

Early adopters are gaining substantial competitive advantages, while late movers face increasingly uncompetitive cost structures. In an industry where net interest margins are measured in basis points, meaningful efficiency advantages determine survival.

The institutions making multi-billion dollar AI investments aren't spending on R&D. They're building moats.

3. Revenue Growth Through Enhanced Decision-Making

Agentic AI doesn't just cut costs. It identifies revenue opportunities that human teams miss or can't act on fast enough.

Direct Revenue Attribution:

Financial institutions are seeing measurable revenue growth from AI, primarily through:

- Enhanced trading performance: AI agents analyze market conditions, portfolio positions, and risk exposures in real time, identifying arbitrage opportunities and optimizing execution timing.

- Predictive risk management: Institutions using AI for credit decisioning approve more borderline applications without increasing default rates. The result: 15-20% portfolio growth without corresponding risk increases.

- Cross-sell and upsell optimization: AI agents identify customers most likely to benefit from additional products based on life events, transaction patterns, and engagement signals. Conversion rates on targeted offers are 3-4x higher than batch campaigns.

Customer Lifetime Value Expansion:

When onboarding takes 3 minutes instead of 10, and account opening abandonment drops 18%, you acquire more customers per marketing dollar. When customer service costs fall 30-40%, you can profitably serve smaller accounts. When claims processing speeds up 40%, you reduce policyholder churn.

These improvements cascade: better service leads to higher retention, which increases lifetime value, which justifies better acquisition spending, which builds market share.

4. Regulatory Resilience and Future-Proofing

Financial services operate in the most regulated environment in the global economy, and regulatory complexity is accelerating, not easing. Agentic AI provides infrastructure to navigate this reality.

Adaptive Compliance:

Traditional compliance systems require manual updates when regulations change. Agentic AI can:

- Monitor regulatory changes: AI agents continuously scan regulatory updates, compare them against current policies, and flag required adjustments before effective dates.

- Maintain audit trails automatically: Every decision made by an AI agent is logged with full context, creating compliance documentation that would take human teams hours to assemble.

- Ensure consistent application: When regulatory rules are encoded in AI logic, they're applied uniformly across all transactions. No more "it depends on which analyst reviewed it."

Risk Management That Scales:

Research shows that early-stage compliance involvement significantly reduces regulatory breach likelihood. Agentic AI makes this involvement economically feasible at scale:

- Real-time AML monitoring: Instead of batching suspicious activity reports weekly, AI agents flag potential money laundering as transactions occur.

- Dynamic risk profiling: Customer risk scores update continuously based on behavior patterns, external data signals, and peer comparisons, rather than waiting for periodic reviews.

- Stress testing and scenario analysis: AI agents can run thousands of portfolio stress scenarios daily, identifying vulnerabilities before they become losses.

5. Workforce Transformation, Not Replacement

The most strategic benefit isn't replacing humans. It's amplifying what human teams can accomplish.

Higher-Value Work Allocation:

When AI handles document validation, data entry, routine risk scoring, and basic customer inquiries, human teams focus on:

- Complex problem-solving: Handling edge cases, resolving disputes, managing escalations

- Relationship building: Deepening customer connections through advisory conversations

- Strategic analysis: Interpreting AI insights to inform product development and market strategy

Research shows that among organizations already using agentic AI, the vast majority report improved operational efficiency and workforce productivity. The productivity gain isn't theoretical; it's showing up in revenue per employee metrics.

Competitive Advantage in Talent Markets:

Financial services face structural labor shortages in specialized roles: underwriters, compliance analysts, fraud investigators, and claims adjusters. Agentic AI doesn't solve the hiring crisis, but it makes each team member 2-3x more productive.

This creates a talent advantage: you can offer better compensation, more interesting work, and clearer career paths because your teams aren't drowning in manual tasks. In tight labor markets, that determines who builds the best teams.

6. Measurable ROI with Clear Payback Periods

Unlike many technology investments that promise "strategic value," agentic AI delivers quantifiable returns quickly.

- Documented Returns: The use case table in the previous section provides detailed metrics across fraud detection, loan processing, customer service, and other critical workflows.

- Predictable Scaling: Research shows strong average ROI within the first 13 months, with returns expected to grow as adoption scales. The compounding effect comes from continuous improvement: unlike static automation, agentic systems get better as they process more data and handle more edge cases.

- Risk-Adjusted Value: The inverse of benefits is also measurable: $40 billion projected fraud losses by 2027 if institutions don't adopt more sophisticated detection. $170 billion in global banking profits are at risk for institutions that don't adapt business models to agentic AI. The cost of inaction now exceeds the cost of implementation.

Implementation Challenges: What Stands Between Strategy and Execution

The gap between planning and execution isn't hesitation, it's complexity. Financial institutions face seven interconnected barriers that determine whether agentic AI delivers returns or stalls indefinitely.

1. Data Infrastructure: The Foundation That's Never Ready

Your customer data lives in a 1980s mainframe. Transactions sit in systems with 90-day retention limits. Risk scores use different customer IDs. Credit data arrives in batch files. Each system speaks a different language.

An AI agent trying to approve a loan needs to reconcile all of this in real time. But different systems use different customer IDs. Address fields contain inconsistent abbreviations. Date formats don't match. Fields that should align often don't.

Legacy infrastructure wasn't built for API access or real-time queries. Data teams are already stretched keeping existing systems running. Creating master data management frameworks requires cross-functional alignment that most institutions lack. The cost of cleanup often exceeds initial AI budgets.

2. Legacy Systems: Technical Debt That Compounds Daily

Core operations run on COBOL from the 1980s. These systems weren't designed for RESTful APIs, real-time queries, or the request volumes AI agents generate. The specialized expertise to modify them is retiring faster than it's being replaced.

Third-party vendors control your policy administration, loan origination, and wealth management platforms. If they haven't prioritized AI-friendly APIs, you're dependent on their roadmap and timeline.

Systems optimized for overnight batch processing collapse under the load of 100,000 daily real-time risk checks. Performance constraints you never noticed in human-operated workflows become bottlenecks the moment AI agents scale. Modernization takes 3-5 years and hundreds of millions.

3. Explainability and Compliance: Trust Is Non-Negotiable

"The AI said so" doesn't satisfy regulators or customers. You must explain loan denials with specific factors income, credit history, debt ratios not model outputs. Bias testing must prove decisions don't discriminate based on protected characteristics. Model risk management requires independent validation of how AI agents work and what risks they introduce.

The EU AI Act imposes penalties up to 6% of global annual turnover for high-risk systems that lack proper documentation, human oversight, and fairness audits. Most agentic AI applications in financial services credit decisioning, fraud detection, underwriting qualify as high-risk.

For complex multi-agent systems that orchestrate workflows across departments, validation is exponentially harder than for simple credit scoring models. Decision paths involve multiple steps, contextual reasoning, and dynamic adaptation precisely the capabilities that make agentic AI powerful but difficult to audit.

4. Organizational Resistance: People Problems Beat Technical Ones

Experienced loan officers, compliance analysts, and claims adjusters spent decades building expertise. Trusting an AI system to make decisions they used to own feels risky even when data proves AI performs better. Job security concerns persist despite "augmentation" messaging. Accountability gets murky: if AI makes a bad call, who's responsible?

You need integrated teams with cross-functional expertise: AI/ML engineers who understand model training, data engineers who build integration infrastructure, business analysts who translate operational requirements, compliance experts who ensure regulatory adherence, change managers who drive adoption. Most institutions have pockets of this talent, not cohesive teams. External hiring competes with tech companies offering better compensation.

Cultural transformation moves slowly in risk-averse environments where careers are built on not making mistakes. Shifting from "perfect compliance" to "intelligent risk management" or from "humans decide everything" to "humans govern AI" requires leadership commitment that extends beyond single projects.

5. Security: AI Creates Risk While Managing It

Deploying AI across financial workflows doesn't just solve security problems, it can introduce new ones. AI agents in FSI need access to sensitive data, transaction histories, credit records, identity documents, to function effectively. That concentration of information in one place creates a high-value target if something goes wrong.

There's also the very real risk of AI getting things wrong quietly. A fraud model that starts missing transactions it should catch. A customer agent that confidently gives incorrect policy information. A credit model reflecting biased historical patterns. In financial services, these aren't just glitches, they're regulatory events and customer harm.

The question institutions need to answer isn't just "does our AI work?" but "what happens when it doesn't?" These are real risks, but they're manageable ones, as long as governance and human oversight are built in from day one, not added as an afterthought.

6. ROI Measurement: Proving Value While Building It

One of the most overlooked steps in any agentic AI deployment is defining what success actually looks like before going live. Without clear goals set upfront, organizations end up chasing vague outcomes and struggling to prove value to leadership.

The metrics you track should reflect where the AI is being deployed. In customer-facing workflows, service, onboarding, dispute resolution, success is measurable in resolution times, abandonment rates, and satisfaction scores. In back-office processes, compliance, fraud detection, loan processing, it shows up in cycle times, error rates, cost per transaction, and false positive volumes. In risk and regulatory functions, it's about early detection rates, audit trail completeness, and breach frequency.

The institutions that get ROI right aren't the ones with the most sophisticated measurement frameworks. They're the ones that walked in knowing exactly what they were trying to move, and built their deployment around proving it.

7. Governance: Building the Guardrails That Enable Speed

Governance done right doesn't slow agentic AI down, it's what gives institutions the confidence to move faster. The key is building it in before deployment, not patching it together after something breaks.

Start with ownership. Every AI deployment needs clear accountability, who signs off, who watches performance, and who pulls the brake if something goes wrong. From there, set your guardrails: define the thresholds that trigger human review, whether that's unusual decision patterns, a compliance flag, or a regulatory update that changes the rules. For high-stakes workflows like credit decisioning or underwriting, schedule bias audits as a recurring practice, not a one-time checkbox.

The smartest approach to balancing speed with control is a tiered one. Begin with high-volume, lower-risk workflows where humans stay in the loop. Prove performance. Build trust. Then gradually extend autonomy as the data earns it. That way, compliance teams get the oversight they need and business teams get the pace they're pushing for, without either side having to compromise.

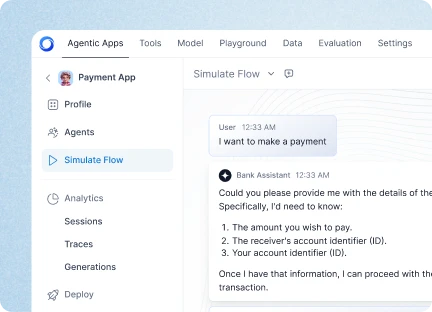

How Kore.ai Addresses What FSI Actually Needs

Kore.ai has built prebuilt agentic applications for banking, insurance, and capital markets, designed around the specific workflows, compliance requirements, and operational realities of FSI, so institutions can deploy with confidence and see outcomes faster.

- Enterprise-grade security and governance by design. SOC 2 and ISO 27001 compliant, with role-based access, data masking, audit trails, and human-in-the-loop controls that meet regulatory expectations out of the box.

- Multi-agent orchestration for complex workflows. Specialized agents across fraud detection, lending, KYC, claims, and customer service collaborate in real time, with intelligent hand-offs and adaptive decisioning across every step.

- No-code speed, pro-code flexibility. A drag-and-drop visual builder lets teams design and deploy workflows without writing a single line of code. Developers can extend capabilities when needed.|

- 75+ prebuilt FSI templates. Purpose-built for banking, insurance, and capital markets, so institutions aren't starting from scratch.

- Model flexibility without vendor lock-in. Choose from leading open-source or commercial LLMs, deployed securely across public or private cloud environments, fine-tuned with Prompt Studio for compliance, tone, and accuracy.

- 250+ prebuilt connectors. Seamless integration into existing CRMs, ERPs, CCaaS, and BI platforms, powering agents with real-time enterprise context from day one.

- Full observability. Real-time dashboards track agent performance, latency, model costs, and uptime, giving teams the visibility to optimize continuously.

The Bottom Line: The Cost of Waiting Has Exceeded the Cost of Acting

Financial services and insurance have always been about managing risk intelligently. But here's what's shifted: the risk calculus has flipped.

The real risk today isn't deploying agentic AI. It's waiting.

While your institution refines its strategy, early movers are already compressing loan timelines from ten days to three, cutting fraud false positives by 85%, and building customer experience advantages that are genuinely hard to reverse. The numbers aren't hypothetical either. $170 billion in banking profits at risk. A $40 billion fraud loss trajectory. A 6.1x shareholder return gap between AI leaders and laggards. These aren't projections designed to manufacture urgency. They're the measurable output of a structural shift that's already well underway.

The institutions that will lead the next decade won't necessarily be the ones with the deepest pockets or the most sophisticated models. They'll be the ones that move decisively from experimentation to execution, with the right governance, the right infrastructure, and the right partners in place.

The window to lead this transformation is open. But it won't stay open forever.

.webp)